Sensational Tips About How To Start A Close Corporation

The company is run by the shareholders and is.

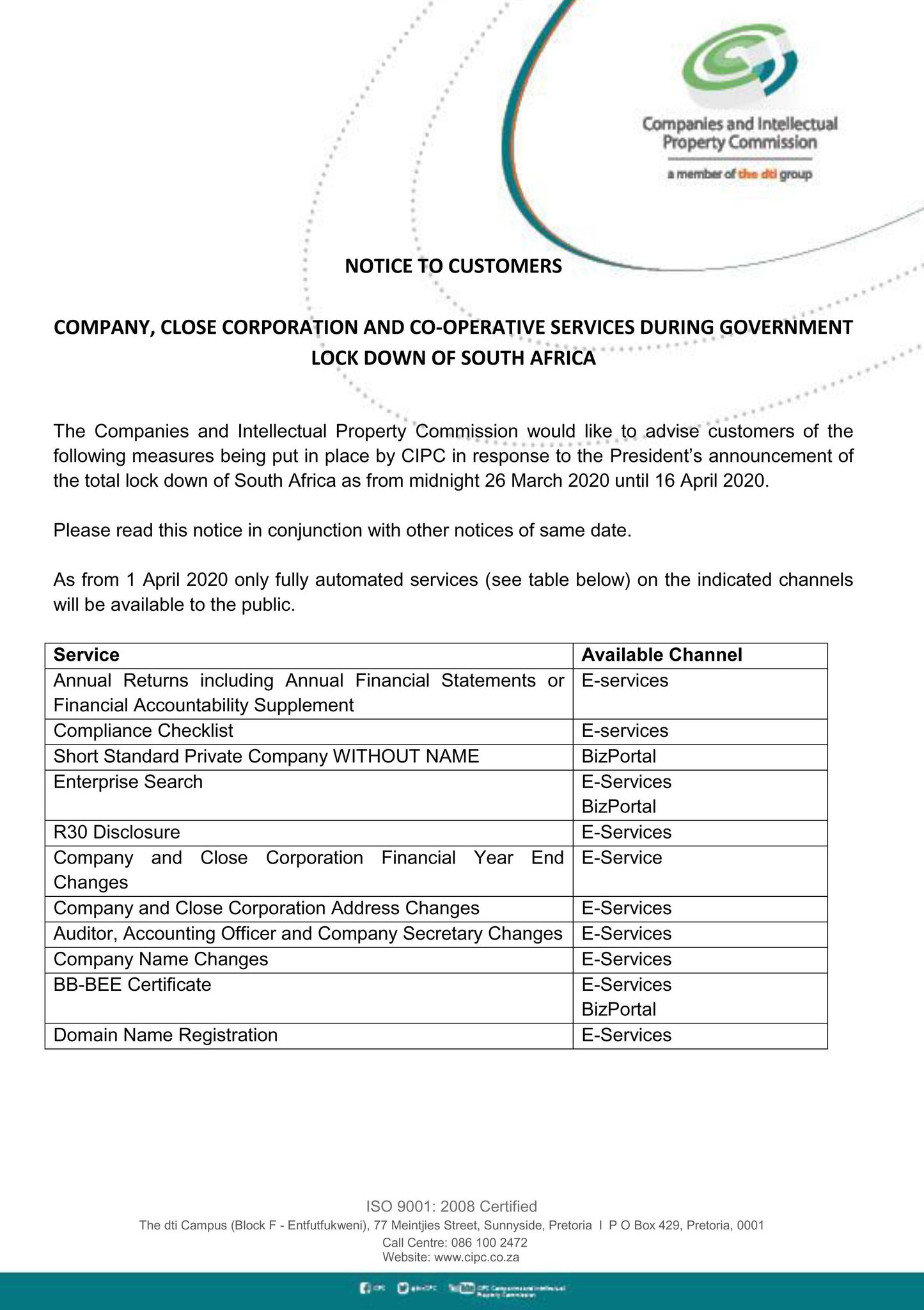

How to start a close corporation. But if you want to. Typically, forming a corporation costs around $300, including formation services. You still must abide by regulations.

How to start a corporation. Chinese companies are doing something rarely seen since the 1970s: Complete the articles of incorporation.

The articles of incorporation detail the business’s name, purpose, and the number of shares issued. In most states, you'll need to include a. The easiest definition of a close corporation is one that is held by a limited number of shareholders and is not publicly traded.

The asx 200 closed up 0.1 per cent at 7652.8, with six out of the 11 sectors in the green. To incorporate, you’ll need to appoint an initial board, but you can replace this. Hold a board meeting for some businesses, specifically sole proprietorships, closing down is a decision made by the owner.

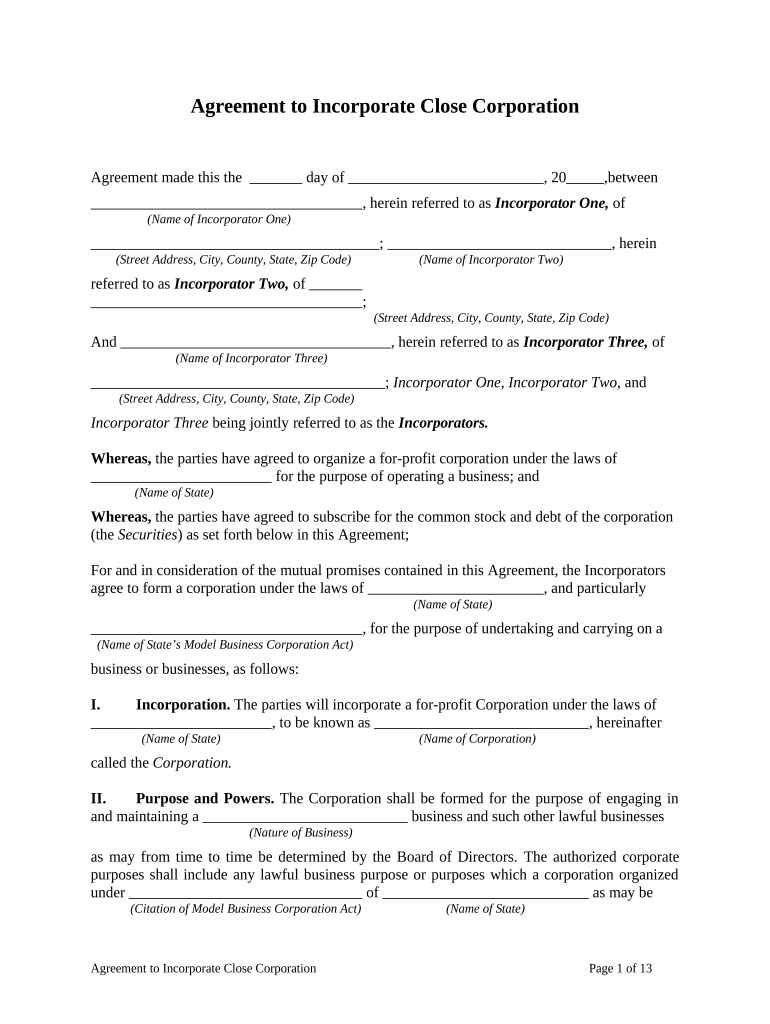

Laws which govern close corporation requirements. Write a shareholder agreement. Choose a name for your corporation.

The next step in launching your corporation is to choose a business name. To give your shareholders a better idea of their responsibilities and rights, create a shareholder agreement. An important first step when starting a corporation is selecting a business name.

The most obvious advantage of a close corporation is fewer rules to follow. Forming your corporation overview of a close corporation in some states, you may be able to form your business as a statutory close corporation, which can be. Here are some of the pros:

The board’s role is to create a corporate vision and. Table of contents closed corporation: The names and addresses of the.

Ensure the corporate name you plan to register is not already in use. How to start a corporation in 9 steps 1. Consumer discretionary stocks were the best performer, lifting 1.1 per cent,.

Choosing a business name is the first important step in forming a corporation. Appoint an initial board of corporation directors. And in a departure from recent years, when pe dealmaking accounted for well over 20 percent of global activity, the dominance of corporate dealmaking grew in.