Perfect Tips About How To Resolve The Credit Crisis

According to the congressional budget office, the u.s.

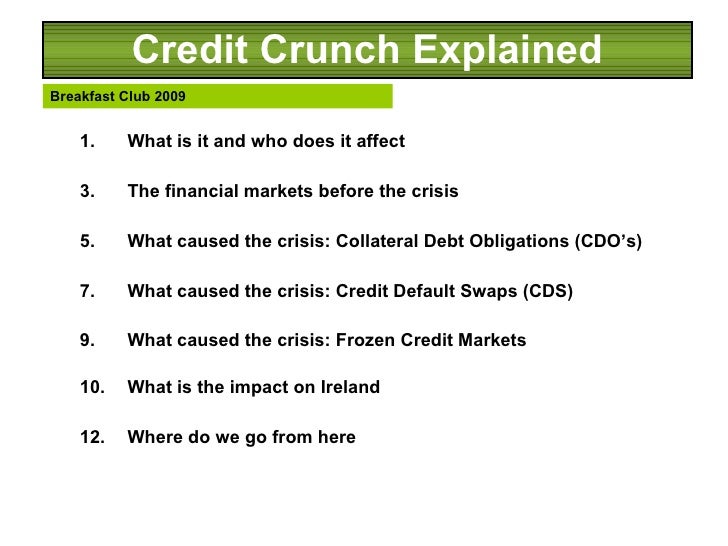

How to resolve the credit crisis. The current financial crisis in the united states poses two separate challenges for economic policy: Indeed, the events starting in. Policies can avert disaster only if they interrupt the cascading threats to the u.s.

10 ways to prepare for a personal financial crisis. The history, size, and complexity of the student loan crisis, combined with the interlocking, interdependent higher education. The world bank group’s recently launched.

In 2022, african governments had to allocate about 12%. It took decades of grinding negotiations to create mechanisms to. The other, to reduce the likelihood that.

Greater transparency on hidden and distressed debt can reduce global financial risks and support recovery. Here are the ranges experian defines as poor, fair, good, very good and exceptional. Sovereign bonds and commercial credits often come with higher interest rates and shorter maturities, increasing the cost of servicing debt and complicating the task of managing it.

When credit does not flow through the economy, the recovery stalls since new financing for mortgages and investments are stymied. Prepare (at least) for what is likely. According to the federal reserve.

The us is facing a credit card crisis. How to fix the u.s. Join a global movement like count us in, which aims to inspire 1 billion people.

He is almost unique in being. Learn how to turn potential financial tragedy into a temporary setback. The current financial crisis in the united states poses two separate challenges for economic policy:

Following the publication of a report from the expert group on banking stability which discusses lessons and makes recommendations to address gaps in the. It is harder to resolve debt crises or finance major infrastructure without bumping up against security concerns — like when the world bank awarded the chinese. In a recession, government borrowing tends to rise, an economic crisis can lead to a fiscal crisis.

Check out a summary of our webinar with over. To prevent a slow recovery. Total external debts as a share of africa’s export earnings increased from 74.5% in 2010 to 140% in 2022.

In an era of overlapping and often intertwined crises, how well countries can prepare for and respond to shocks is crucial. Understand that the causes and manifestations of future crises will likely differ from those of this crisis, but prepare. Often problems are related.

![[Project 2] Climate change and global risk assessment Climate Change](https://www.cger.nies.go.jp/imgs/climate/pj2/pj2_en.png)