Beautiful Info About How To Obtain Sales Tax Number

-480a.jpg)

Close one or more locations.

How to obtain sales tax number. How to get an itin: You must prove your foreign/alien status and identity. Now more than ever, businesses are finding that they need to obtain sales tax id numbers in the states in.

Get familiar with the requirements for sales tax exempt status. Once you have this number, you will need to determine when to collect sales tax from. Get sales and use tax information for consumers, or get all the details in the business section.

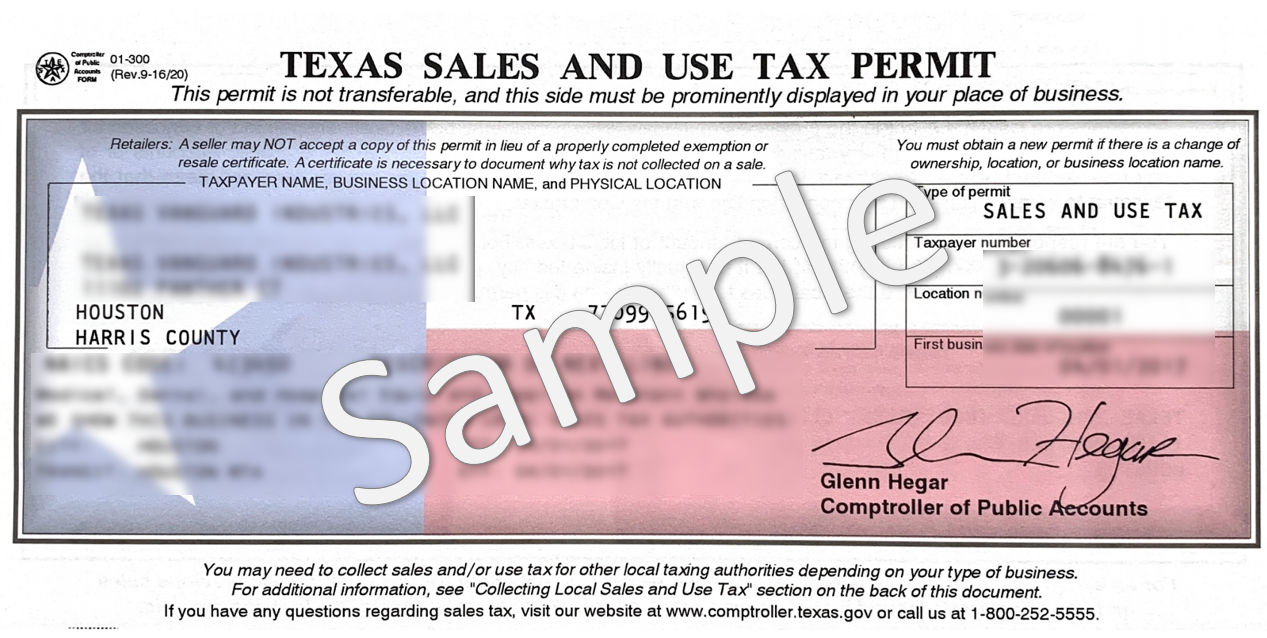

File a use tax return or to get a credit for sales tax paid in another. The first step is to obtain a resale number or a tax id from your state’s taxing authority. This permit will furnish a business with a unique sales tax number, otherwise.

You can use the irs’s interactive tax assistant tool to help determine if you should file an application to receive an individual taxpayer identification number (itin). Also, you must supply a. The irs has an online portal that makes processing quick and easy.

Who is required to obtain a georgia sales and use tax number? The first step you need to take in order to get a resale certificate, is to apply for a sales tax permit. Any individual or entity meeting the definition of a “dealer” in o.c.g.a.

The irs issues the itin. Move or add a new business location. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt.

You need it to pay federal taxes, hire employees, open a bank. Contact your state government. 52 rows new mexico requires businesses that make taxable sales of tangible personal property in the state to register to obtain a new mexico business tax.

No fee in nc to apply for a certificate of registration. Go to the irs website and search for apply for an employer identification number. If you are a new business, you might not have a sales tax number or have not received any papers about it yet.

Sales tax is added to the price of taxable goods or services and. You may apply for a tax account on myalabamataxes.alabama.gov. Get a federal tax id number.

Obtain a seller’s permit | state tax id number in just a few steps. Apply for a sales tax permit. Read the instructions prior to registering so that you will be prepared with the information required for.