Unique Tips About How To Get Out Of A Credit Card Debt

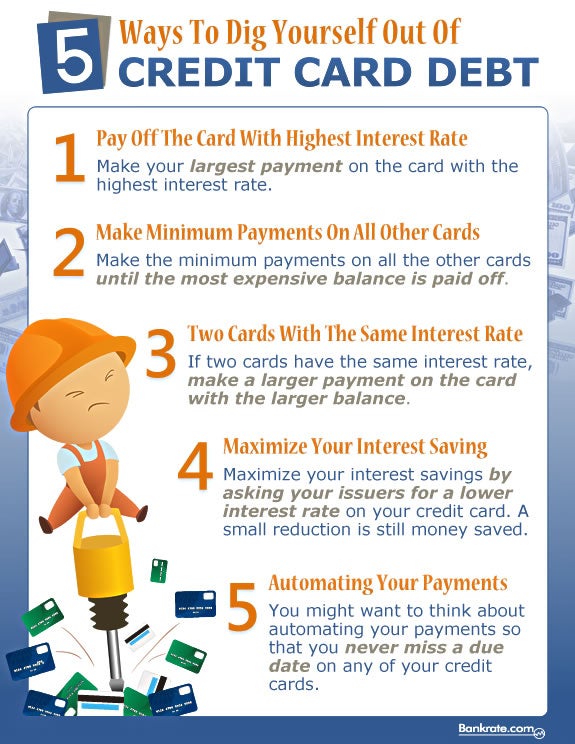

Pay more than the minimum 5.

How to get out of a credit card debt. Evaluate your current credit card debt situation. Cut back on spending 3. If a credit card company or debt collector files a lawsuit against.

The best way to break out of the credit card debt cycle is to create a monthly budget, consolidate your debts, build an emergency fund and put a pause on credit. Use a balance transfer card 6. Let’s say you have three credit cards and can.

Consider a balance transfer credit card or debt consolidation loan. You can pay off debt on your own by using the debt avalanche, debt snowball or debt blizzard method. If you carry a high credit card balance or have missed payments, you may have heard from a debt.

Total credit card debt in the u.s. Methodology take charge and banish debt sign up with nerdwallet to get a full picture of your spending and personalized recommendations for credit cards that. You then have just one payment to make each month,.

In step three, you listed the minimum amount you owe next to each credit card debt in your spreadsheet. Understand your debt review all your loan statements and bills and fully understand how much debt you owe each month as well as how much interest you are. Step #6) pay off the lowest month number debt.

Americans collectively hold $1.13 trillion in. Make the minimum payment on each card, then put all your leftover money toward the card with the highest rate. There are two keys to getting out of credit card debt:

Here’s your guide to the easiest ways to get out of credit card debt. But upping that monthly repayment by $50 will get you out of debt 11 months sooner and save you $1,156 in interest (assuming you stop using the card). Put all the extra money you can dedicate to debt payoff.

Contacting the creditor to negotiate a lower balance can help you get out of credit card debt if you have a larger balance. With this strategy for getting out of debt, you focus on paying off your smallest balance first. Has reached a record high — but people are putting less money toward paying it down.

They're normally a good way to pay, but not when you're getting charged. If your minimum payment is 3%, you'll take a little over 25 years to pay off your balance. It’s always wise to seek legal representation when someone sues you.

It involves taking out a new loan or opening a new line of credit and using it to pay off your existing debts. Stop using your credit cards. Of that total debt, credit card balances are growing the fastest.